Invested Funds

Consolidated Endowment Fund (CEF)

Strategy

The investment objective of the Endowment is to achieve a return consistent with a level of risk that is appropriate for the University. Given the marginal impact of the Endowment's current spending rate relative to the University's annual operating budget, the Office of Investments & Banking pursues a higher risk/return strategy than many of its peers. Much of this risk allocation arises through Venture Capital investments that make up a significant portion of the portfolio. But overall the Endowment seeks to achieve higher returns through private funds structures across all of its asset allocation categories. The long-term strategic objective of the Endowment is to target the portfolio's exposure to illiquid assets of approximately 50 percent in normal market environments.

The Endowment invests in a broad array of assets, including global stocks, US Treasury bonds, real estate, natural resources, private equities, private debt, hedge funds, and many other strategies. The Office of Investments & Banking achieves exposure to these categories by almost exclusively selecting and engaging external managers, but has the ability to make selective co-investments through existing manager relationships.

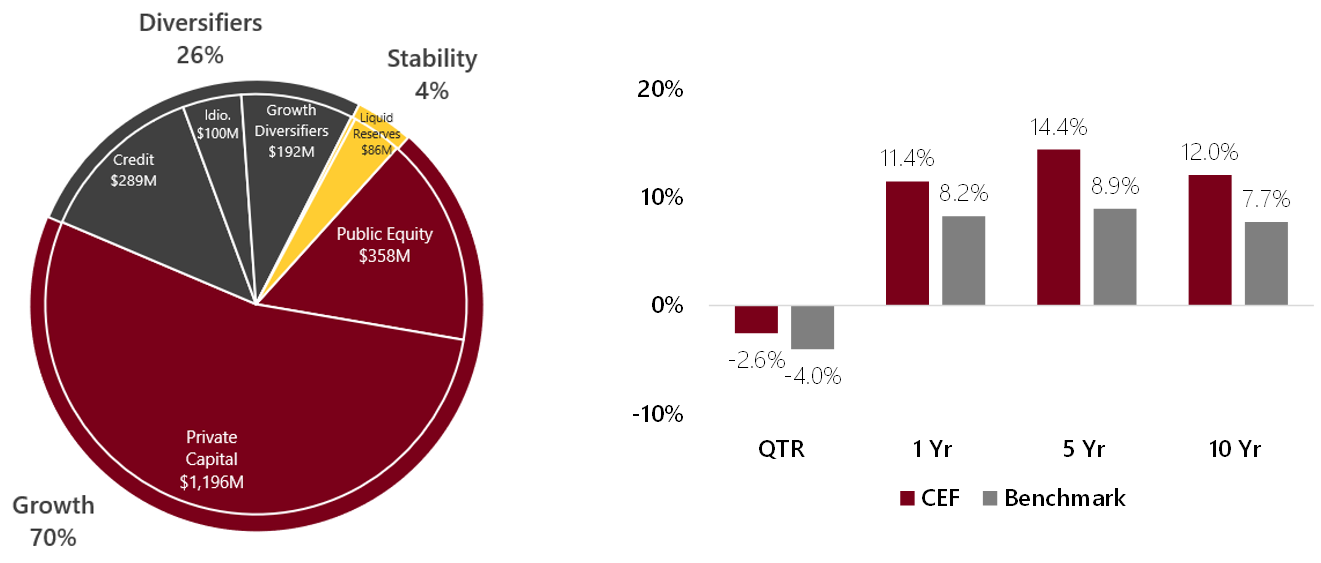

Asset Allocation

In seeking to maximize returns within managed risk parameters, the Office of Investments & Banking has developed a purpose-driven framework for asset allocation. This framework offers a clear methodology to construct a portfolio by segmenting assets into categories that align with an investment objective, instead of pursuing legacy asset class buckets.

To achieve higher returns, the Endowment pursues investments in private funds structures across most of the portfolio. Generally, investments range in size from $5 million to $25 million, depending on capacity and asset allocation constraints. Due to the size of commitments and overall risk tolerance, the Office of Investments & Banking tends to focus on niche strategies and smaller funds where alpha generation is often more significant.

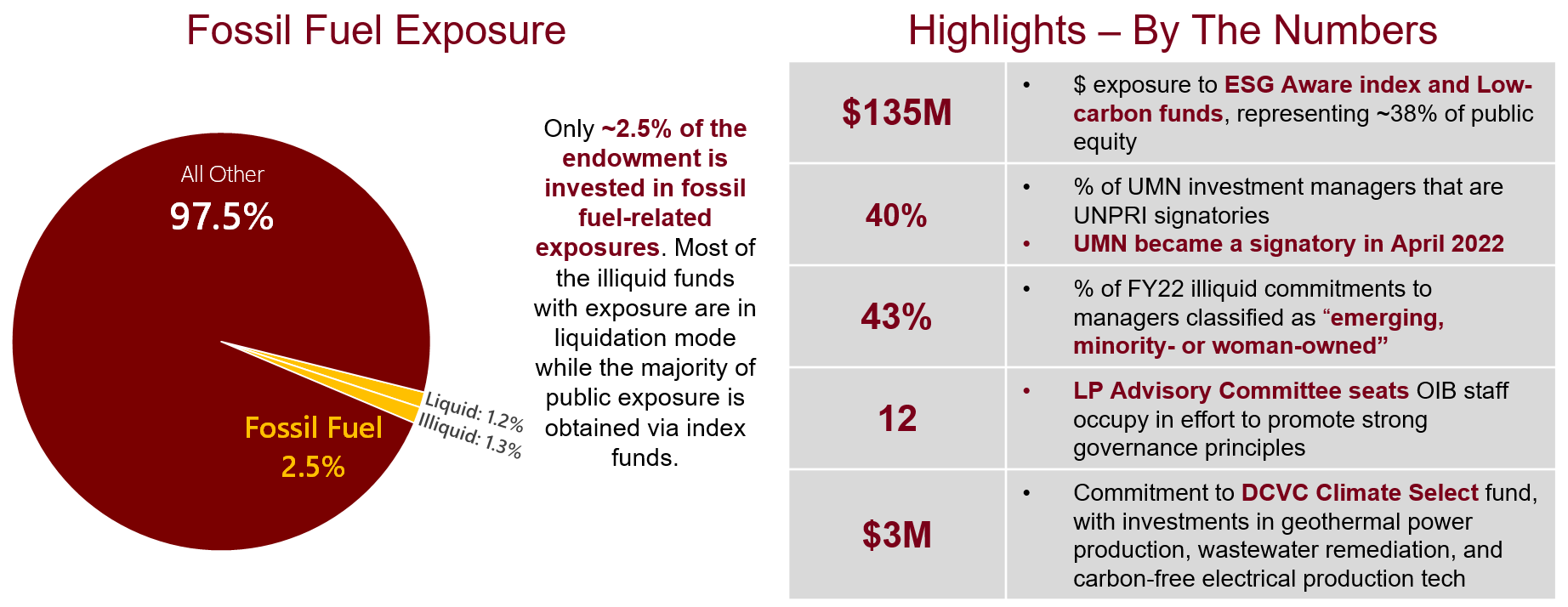

Endowment Fund FY22 ESG Dashboard

The Office of Investments & Banking (OIB) is charged with considering Environmental, Social and Governance (ESG) principles in the investment decisions and providing transparency.

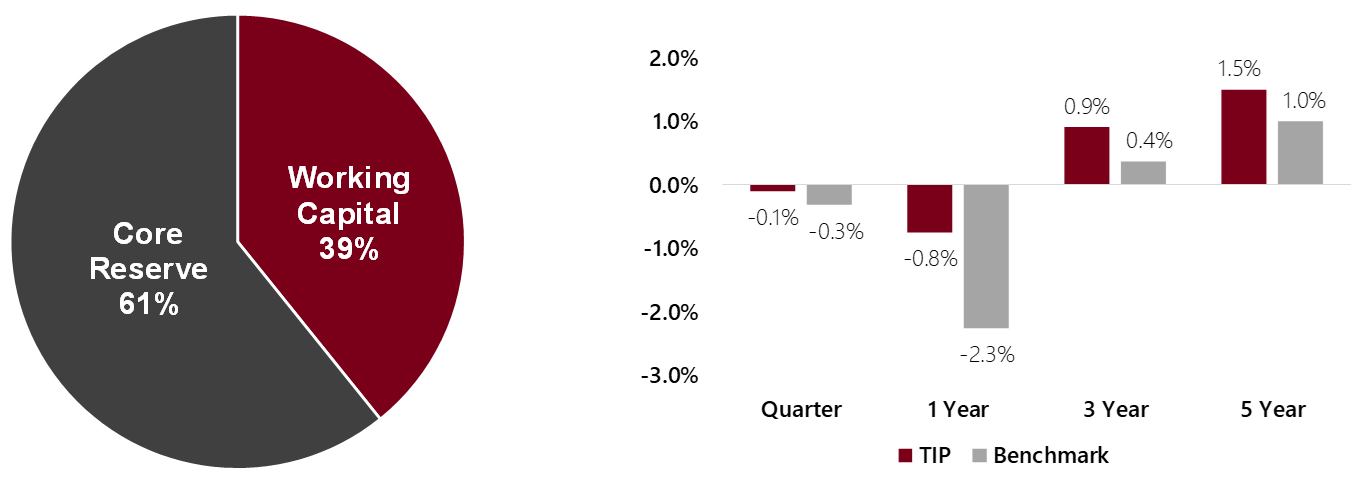

TIP (Temporary Investment Pool)

TIP represents the short-term reserves and the working capital of the University

- The primary investment objective of TIP is to generate current income and capital preservation.

- Other priorities for TIP are to maintain sufficient liquidity to meet near-term funding and operations requirements of the University, and to provide backup liquidity for certain of the University’s short-term and variable rate debt obligations.

TIP Asset and Allocation Performance

Most TIP assets are invested in short and intermediate-term US government treasuries or agency bonds. Less than 20% of TIP assets are allocated to external investment managers seeking higher return from diversified portfolios of credit exposures. Earnings from the TIP pool are contributed to the University’s central reserve for reallocation.

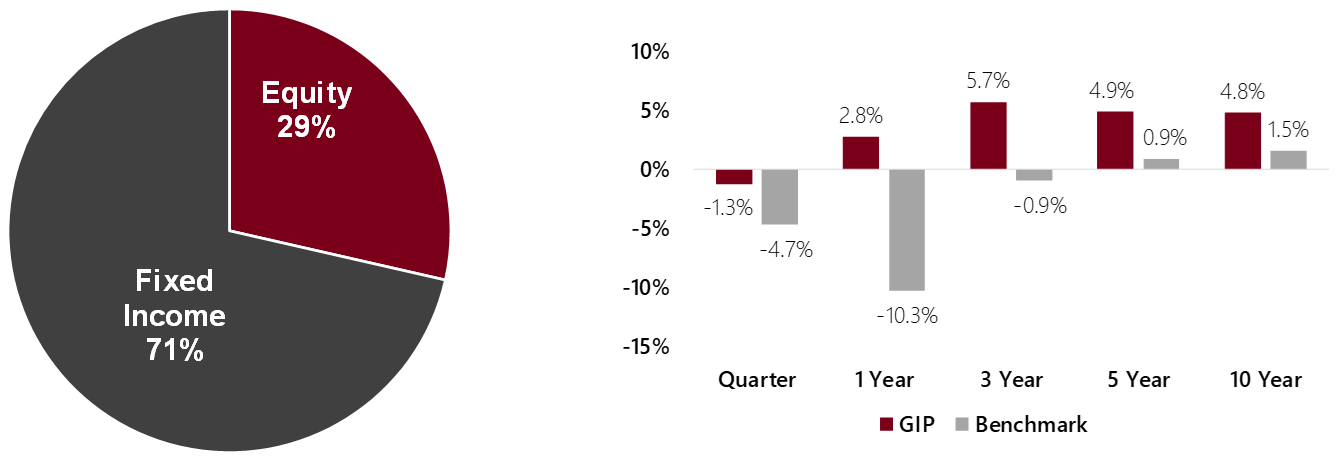

GIP (Group Income Pool) Overview

GIP represents the financial assets held as long-term reserves by various operating units of the University

- These long-term reserves are primarily used to fund expenditures not budgeted to be spent for three years or more.

- The primary investment objective of GIP is to maximize total investment return while preserving capital balances until such time as the principal is required to fund the intended use.

GIP Asset Allocation and Performance

The equity allocation in GIP is invested in the University’s Consolidated Endowment Fund. Fixed income investments are intended to provide a reserve to fund obligations as well as produce income through enhanced yield. These investments consist of high-grade fixed income securities, emerging market debt, and private senior credit strategies.

RUMINCO LTD Overview

RUMINCO Ltd. is a captive insurance company wholly owned by the University of Minnesota with headquarters in Bermuda. It provides the University with the following coverage:

- Business Auto Liability

- Non-profit Organizational Liability

- Commercial General and Professional Liability

Responsibility for investing the liability reserves and the capital surplus has been delegated by its Board of Directors to the Office of Investments & Banking, subject to provisions in the Investment Policy Statement.

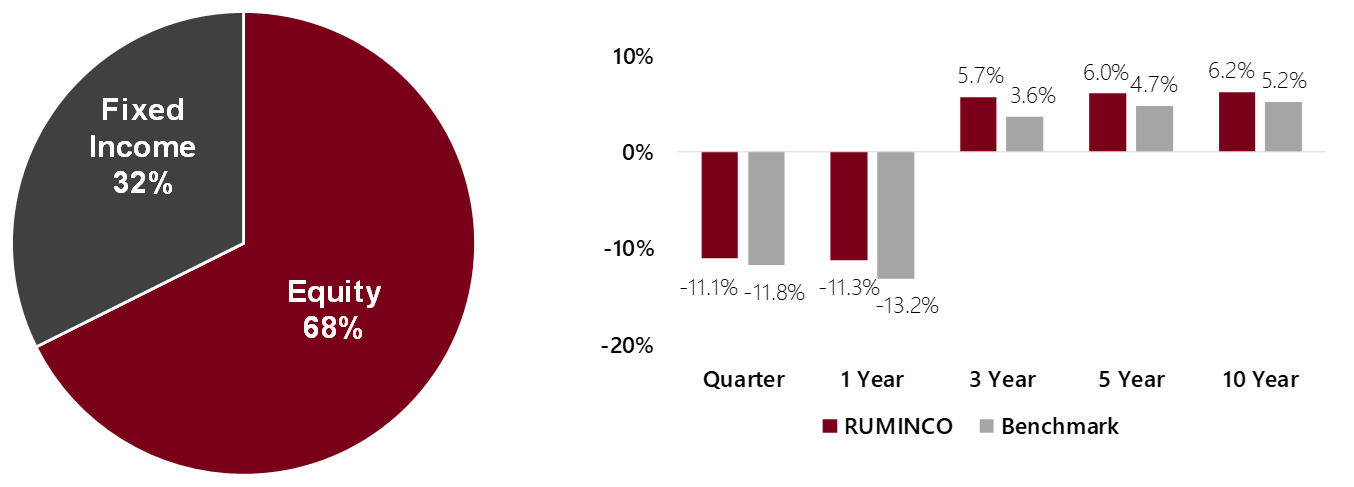

RUMINCO Asset and Allocation Performance

The RUMINCO equity allocation is invested in a broadly diversified global equity index fund. A reserve allocation is maintained to address current year known and expected claims and is held in cash or short-term US government securities, while the remaining fixed income allocation is invested with three external investment managers and is intended to preserve principal and enhance yield.

SSBCI Venture Capital

Leveraging the strengths of both the University and state government, the Office of Investments & Banking is honored to provide its investment expertise to manage the State Small Business Credit Initiative (SSBCI) Venture Capital Programs on behalf of the Department of Employment & Economic Development (DEED). For further information, visit the University's SSBCI Venture Capital Program website at mnssbcivc.umn.edu.

Contact Us

Campus mail: 145 UOffPl (del code 2704)

Main Phone Number: 612-624-5558 | Fax Number: 612-626-7271

Email: [email protected]

2221 University Avenue SE Minneapolis, MN 55414 Suite 145